| Welcome to the May issue of the Select Wealth Management Dashboard Newsletter. What a difference a month makes. When I wrote last month's newsletter, it was against a backdrop of falling markets, bad news, panic and extreme pessimism. Trump had pushed the big red button on tariffs, and the world was about to implode. But since then, the tariffs have been deferred, deals are being done, and the waters have calmed (for the time being). Markets have responded extremely positively, and made back all of their losses. The S&P500 (American share market) rose for 9 days in a row - the longest "winning streak" in over 20 years. It rose 9.58% in a single day when the tariff deferral was announced - the 3rd biggest single day rise since WW2. Apple (the world's biggest company) rose 15% on the deferral news - its biggest one day gain since 2008. Not for the first time, the patient investor has been rewarded.

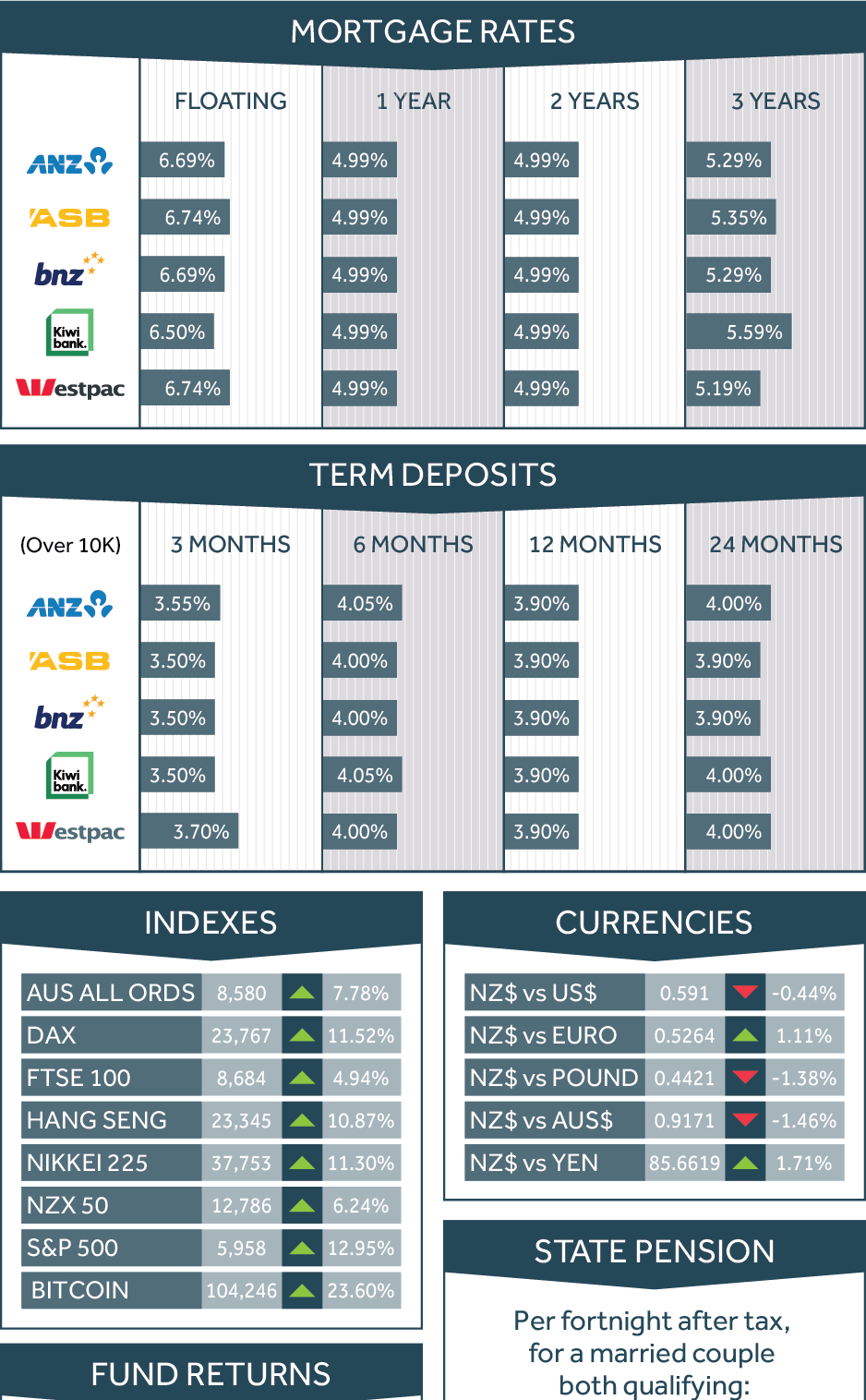

Whether this was Trump's masterplan all along, or whether it was Trump caving in to mounting public pressure will never be known (perhaps not even by him...). But the markets and investors don't need to discern - the fact is that markets like the outcome, however we got there. Ironically, after all the noise, drama, extreme volatility and a tumultuous month, most markets ended the month of April where they started. If you had somehow avoided all the news (which would have required you being in an information vacuum somewhere), you would be forgiven for thinking that April was just another regular month. The S&P500 started the month at 5,597 and ended it only 0.50% lower at 5,569. Nothing to see there. However, this hides the fact that during the month it fell as low as 4,910 (or 12%) before recovering this all back. This was some of the most extreme volatility I have experienced in my 25 years of investing money on behalf of clients. The past month also saw another material development in the investing world. At the ripe old age of 94, Warren Buffett, CEO of investment firm Berkshire Hathaway, has finally decided that it's time to retire. I have been an admirer of Warren Buffett for many years. Also known as the Oracle of Omaha, he has an envious investment record which is second to none. Since taking over as CEO in 1965, his fund has delivered an incredible 20% per annum return. $10,000 invested in his fund in 1965 is worth a staggering $550,000,000 today. He has enjoyed incredible success, and created significant wealth for his clients along the way. The most admirable thing about Warren Buffett for me though is his character. He is a humble gentleman, always fast to point out his shortcomings and gloss over his successes. He lives a notoriously modest life, still living in the first home he bought in Omaha for $31,800 in 1958 despite being in the top 10 richest people in the world. He is the epitome of the good old fashioned, honest businessman. In the trenches, doing the work, pressing the flesh. Known to do multi-million dollar deals over a lunch and a handshake, his long term thinking and ethical business practices were legendary. Buffett's investment temperament is uncanny. There have been many times that I have referred to his newsletters or literature to calm me and give me perspective when markets got scary. He is the eternal investment optimist, but also knows never to pay a cent more for a company than it is worth. Patience and discipline form the foundation of his investment strategy, only investing in businesses he understands, and never paying more than fair value for them. His whit and great sense of humour has led to many quotes and truisms that investors the world over refer to regularly. Some of my favourites: Someone's sitting in the shade today because someone planted a tree a long time ago You should never test the depth of the water with both feet Beware the investment activity that produces applause; the great moves are usually greeted by yawns Be fearful when others are greedy. Be greedy when others are fearful Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future The stock market is a device for transferring money from the impatient to the patient Do not save what is left after spending; instead spend what is left after saving An idiot with a plan can beat a genius without a plan It takes 20 years to build a reputation and five minutes to ruin it. If you think about that you'll do things differently It's only when the tide goes out that you learn who's been swimming naked So here's to Warren Buffett - enjoy your retirement sir. Your wisdom will live on long beyond today and guide many future investors for decades to come. Look out for his name in the context of Philanthropy now, as he has committed to giving away 99.5% of his US$161 billion wealth to worthy causes. I imagine that would be a full time job in retirement for him... In terms of the markets, the past 30 days have been very strong. As I mentioned before, share markets have had a very strong performance, up between 5% (London's FTSE) and 13% (America's S&P500). Australia and New Zealand had slightly more muted returns, but then they weren't down as heavily as other markets last month. House prices remain unchanged, and term deposit rates slid down slightly. All the major banks can now offer a 2 year mortgage at under 5%. |

||||||

|

||||||

In terms of your Select Wealth Management portfolio, there is nothing specific to report this month. In some portfolios we have removed the OneAnswer International Share Fund and replaced this with the Hyperion Global Growth Fund in an effort to get portfolios more concentrated and create greater opportunity to growth. We remain comfortable with all other managers at this stage. Your tax report is now available on the portal (feel free to contact me if you need a copy and don't use the portal). Finally, a quick update on our Giving Back program. We've had a busy couple of months and are making good progress towards our target of $2,500 for Lower Hutt Woman's Refuge. As always, thank you for the referrals of your friends, family and colleagues which makes it possible for us to continue with this program. You can follow progress of the campaign at https://mifinancialplanning.co.nz/giving-back.html Warm regards Dave and the team at Makowem & Isaacs Financial Planning dave@mifinancialplanning.co.nz |

||||||

|

||||||

This newsletter is intended for general distribution and does not constitute personal financial advice.